2022 Commercial Gaming Revenue Tops $60B, Breaking Annual Record for Second Consecutive Year

Traditional and Online Verticals See All-Time Revenue Highs

Washington, D.C. (February 15, 2023) — AGA’s Commercial Gaming Revenue Tracker provides state-by-state and cumulative insight into the U.S. commercial gaming industry’s financial performance based on state revenue reports. This issue highlights results for the full calendar year 2022, as well as the fourth quarter.

Q4 and Full-Year 2022 Commercial Gaming Revenue

AGA’s Commercial Gaming Revenue Tracker provides state-by-state and cumulative insight into the U.S. commercial gaming industry’s financial performance based on state revenue reports. This issue highlights results for the full calendar year 2022, as well as the fourth quarter.

2022 Gaming Revenue Soars Past Previous Record, Growing Nearly 14%

Despite persistent concerns about the financial health of American consumers throughout 2022, the U.S. gaming industry generated record-breaking revenue for a second consecutive year.

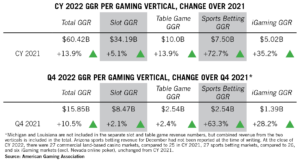

According to data compiled by the American Gaming Association (AGA), commercial gaming revenue – encompassing traditional casino games, sports betting and iGaming – reached $60.42 billion in 2022, a 13.9 percent increase over 2021 and 38.5 percent higher than 2019.

Total annual U.S. gaming revenue in 2022 will likely exceed $100 billion for the first time. This will be confirmed when tribal gaming revenue is reported by the National Indian Gaming Commission later this year. For context, combined commercial and tribal casino gaming is on par with overall U.S. beer sales, which hit $100.2 billion in 2021.

On a monthly and quarterly basis, the gaming sector closed out 2022 on a high note despite the broader economic environment and tougher comparisons to the previous year. The fourth quarter saw a 10.5 percent year-over-year increase in commercial gaming revenue to $15.85 billion, while December marked the single highest grossing month on record with a 16.7 percent year-over-year increase to $5.43 billion.

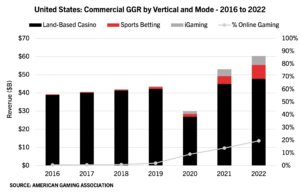

Growing the Pie: In-Person Gaming Has Record Year, Online Now One-Fifth of Revenue

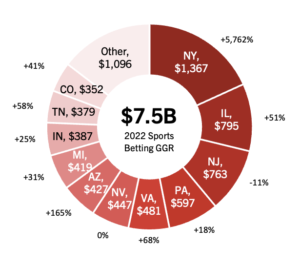

Each of the three major verticals – casino slots and table games, sports betting and iGaming – generated individual revenue records in 2022. Casino slots and table games generated a combined total of $47.83 billion, accounting for 79.3 percent of total commercial gaming revenue. Sports betting brought in $7.50 billion (12.4% of total) while iGaming totaled $5.02 billion (8.3% of total).

In-person gaming remains the backbone of the industry with online gaming representing a growing share of the total. In 2022, brick-and-mortar casinos and retail sports betting accounted for 80.5 percent of total gaming revenue, while combined revenue from mobile sports betting and online casinos made up 19.5 percent.

The portion of overall U.S. gaming revenue derived from online platforms remains low in comparison to other major international markets such as the U.K. (65%), France (∼29%) and Germany (∼28%). At the state level, however, the combined share of online sports betting and iGaming in the four states that offer both commercial land-based and full online gaming options averaged 40.7 percent.

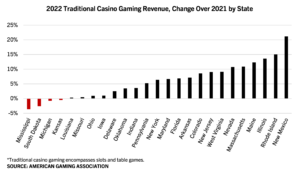

Most Gaming States Post New Annual Records

Thirty-two commercial gaming jurisdictions saw an increase in gaming revenue compared to 2021, with 29 states setting new annual records. This included the new Nebraska market, as well as four states that reported their first full year of revenue: Arizona, Connecticut, Virginia and Wyoming.

Mississippi (-3.6%) and South Dakota (-2.2%) saw annual revenue contract compared to 2021, which can be attributed to tougher year-over-year comparisons after dropping pandemic restrictions faster than other states. Additionally, the sports betting-only market in Washington, D.C. continued to lose ground to neighboring Maryland and Virginia.

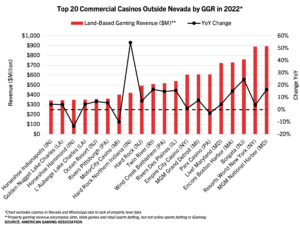

Top Casino Markets, Properties See Continued Reshuffling

In 2022, 14 of the top 20 commercial casino gaming markets posted revenue growth compared to the previous year. The Las Vegas Strip (NV) and Black Hawk/Central City (CO) had significant gains year-over-year, while the southern markets of Tunica/Lula (MS) and Shreveport/Bossier City (LA) contracted due to increased competition from casinos in nearby states.

After a turbulent two years with markets rising and falling largely due to varying pandemic restrictions, market rankings stabilized in 2022. The Baltimore-Washington, D.C (DC/MD/WV) and Chicagoland (IL/IN), markets continued their back and forth between the third and fourth largest markets, with the D.C. area reclaiming its spot as the third largest market. Meanwhile, Black Hawk/Central City (CO) and Pittsburgh/Meadowlands (PA) jumped two and three spots, respectively, while Tunica/Lula (MS) fell two positions.

At the property level, MGM National Harbor in Maryland narrowly surpassed Resorts World New York City in Queens, NY as the highest grossing commercial casino in terms of gaming revenue outside of Nevada. The Maryland property benefited from a full year of retail sports betting, which is currently unavailable at the New York property. Meanwhile, Atlantic City’s Borgata gained two slots and reclaimed its spot among the top three commercial properties.

In 2022, 17 of the 20 highest grossing casinos realized gaming revenue growth compared to 2021. Notably, Hard Rock Northern Indiana saw the largest gain (+55%) in the newly-renovated property’s first full year in operation.

Powered by Rebounding Visitation and Strong Consumer Spend, Brick-and-Mortar Gaming Sets New Record

In 2022, traditional casino gaming continued to thrive, with combined slot and table game revenue increasing by 6.4 percent to an annual record of $47.83 billion. Slot revenue saw a 5.1 percent year-over-year increase, while table revenue rose 13.9 percent, reversing the 2021 dynamic where lingering COVID-related restrictions had a greater impact on table game operations. Compared to 2019, both verticals accelerated in 2022 at an almost identical rate, with slot revenue rising by 15.7% and table game revenue increasing by 15.1%.

Nearly all markets with brick-and-mortar slot machines and/or table games experienced yearly growth, with only four states contracting: Kansas (-0.5%), Michigan (-0.8%), Mississippi (-3.6%) and South Dakota (-2.6%). Mississippi and South Dakota had been quick to lift pandemic restrictions in 2020/2021 and were disproportionally impacted by difficult annual comparisons throughout 2022. South Dakota was also affected by the closure of three gaming properties in Deadwood during the year.

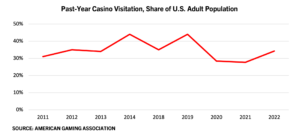

The record year for traditional casino gaming was powered by markets opening in Nebraska and Virginia and a strong nationwide rebound in visitation after a two-year pandemic-dip. In 2022, 34 percent of the adult population or 84 million American adults visited a casino, up 6% from 2020 and 2021 but still down 10% from the high in 2019.

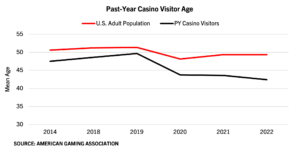

Meanwhile, the average age of adult Americans visiting casinos has decreased since the start of the pandemic and is trending increasingly younger than the adult population overall. The average age of a casino patron was 42.4 years old, down from 43.6 in 2021 and 49.6 in 2019.

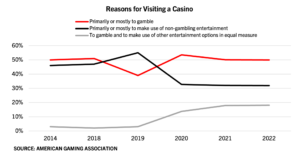

The pandemic not only shifted casino visitor demographics but has also produced a more gaming-oriented mix of consumers. Compared to pre-2020, fewer people are visiting casinos mainly to take advantage of non-gaming amenities, while more are now splitting their time between gaming and other entertainment offerings.

Average gaming spending per casino visit, which had already been steadily increasing for years, saw a sharp acceleration in 2020 that has continued over the last two years. In 2022, available casino data from five midwestern and southern states—Illinois, Iowa, Louisiana, Mississippi and Missouri—shows an increase of between 14.3 and 49.3 percent from 2019 levels. The average gaming spend remained largely unchanged from 2021.

Sports Betting and iGaming Accelerate to Record Year and Quarter

While land-based gaming still dominated the overall gaming revenue pie, sports betting and iGaming saw tremendous growth in 2022, setting new annual records including quarterly highs in Q4.

Nationwide sports betting revenue soared 72.9 percent year-over-year, from $4.34 billion in 2021 to $7.50 billion in 2022, as Americans bet a total of $93.2 billion on sports throughout the year. The growth was driven by the launch of legal betting in Kansas and the addition of mobile betting in Louisiana, Maryland and New York. All but two sports betting markets increased handle last year: Delaware (-32.3%) and Mississippi (-9.2%).

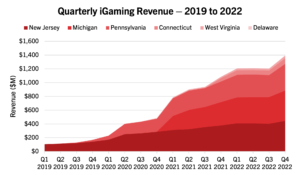

The geographically smaller iGaming market also continued to break records in 2022, with combined iGaming revenue from six active states (excluding Nevada) reaching $5.02 billion, a 35.2 percent increase year-over-year. Notably, iGaming’s growth came without any new states launching in 2022.

The geographically smaller iGaming market also continued to break records in 2022, with combined iGaming revenue from six active states (excluding Nevada) reaching $5.02 billion, a 35.2 percent increase year-over-year. Notably, iGaming’s growth came without any new states launching in 2022.

The year ended on a high note with the vertical setting a new quarterly record of $1.39 billion in revenue, up 28.2 percent from Q4 2021. Each of the five iGaming markets that were operational throughout 2021 set new annual records for the vertical, as revenue expanded between 15.9 percent (NJ) and 90.2 percent (WV) on the previous year.

About the Report

AGA’s Commercial Gaming Revenue Tracker provides state-by-state and nationwide insight into the U.S. commercial gaming industry’s financial performance. Monthly updates on AmericanGaming.org feature topline figures based on state revenue reports while quarterly reports provide a more detailed analysis covering the three previous months.

SOURCE: American Gaming Association (AGA).

Tags: American Gaming Association (AGA), Commercial Gaming Revenue Tracker, 2022 Commercial Gaming Revenue