Gaming Industry Outlook: Executive Sentiment Normalizes as Indicators Point to Deceleration

Washington, DC (April 25, 2023) — Growth in the U.S. gaming industry continued at a strong pace through the first quarter of 2023 but is expected to decelerate over the next six months, according to the AGA Gaming Industry Outlook, presented by Fitch Ratings.

Washington, DC (April 25, 2023) — Growth in the U.S. gaming industry continued at a strong pace through the first quarter of 2023 but is expected to decelerate over the next six months, according to the AGA Gaming Industry Outlook, presented by Fitch Ratings.

The Gaming Industry Outlook provides a snapshot of the current and future economic health of the industry based on executive sentiment, casino visitation plans, gaming revenue and economic indicators. The Outlook includes two separate indices:

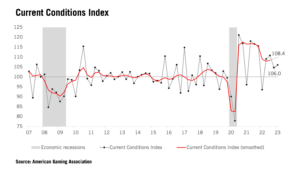

- The Current Conditions Index measured 106.0, reflecting strong growth in casino gaming-related economic activity in the first quarter relative to the prior quarter (index values above 100 indicate activity is increasing).

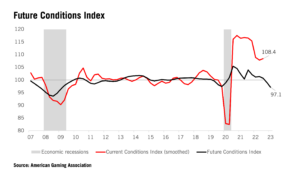

- The Future Conditions Index decelerated to 92.9, indicating that annualized industry economic activity over the next six months is expected to decrease moderately.

The weaker outlook is evident in the Future Conditions Index reflects a baseline economic outlook that anticipates a mild recession during the second half of this year, as well as a shift to a more cautious view of future conditions by the Gaming Executive Panel. While most executives view current business conditions as good, the view on future conditions is more balanced, with two-thirds of executives expecting future conditions to be “satisfactory.”

Index highlights

The Current Conditions Index indicates that real economic activity in the industry, as measured by gaming revenue, employment and employee wages and salaries, remains strong, but that the pace of growth has slowed some relative to earlier in 2022 and 2021. The Current Conditions Index for the first quarter of 2023 was 106.0, which is consistent with annualized growth of 6.0 percent. Because gaming revenue and employee wages are adjusted for inflation, continued high inflation through Q1 2023 tempered the Current Conditions Index.

The smoothed version (effectively a three-quarter weighted average) of the Current Conditions Index, which is reported with a two-quarter lag and is less impacted by short-term fluctuations, stood at 108.4 in Q3 2022. This indicates that industry activity has been expanding in recent quarters at an annualized pace of approximately 8.4 percent and reflects real underlying growth even when controlling for the effects of inflation.

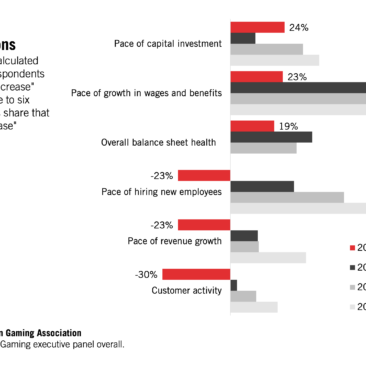

Gaming CEO Growth expectations remain positive but have softened relative to six months ago, according to the Gaming Executive Panel, a major input in the Future Conditions Index. In aggregate, across a set of outlook questions, the share of positive responses on measures such as future business conditions outweighed negative responses by 4.1 percentage points this quarter, as compared to 24.7 percentage points in Q3 2022.

The Future Conditions Index reflects the current Oxford Economics forecast that the U.S. economy will experience mild recession in the second half of 2023, with consumers coming under pressure as nominal income growth softens, savings buffers decline, inflation remains high, and business investment spending slows.

The Future Conditions Index is moderately boosted by consumer survey results that indicate that the share of adults that expect to visit a casino during the next 12 months increased in the most recent quarter.

The Future Conditions Index is calculated to provide a leading indicator of changes in industry conditions. The 92.9 reading on the Future Conditions Index in Q1 indicates an environment in which real economic activity in the gaming sector is expected to decrease over the next six months (-7.1% annualized rate).

GAMING EXECUTIVE PANEL HIGHLIGHTS

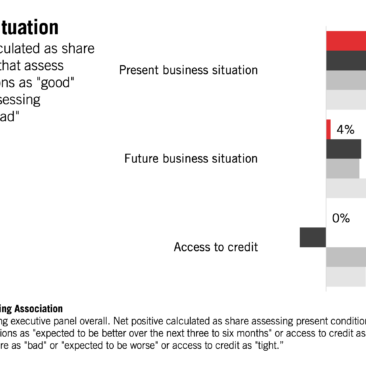

Gaming executives report current conditions are good, but they have become more cautious about future conditions. Overall, almost all respondents characterized the current business situation as good (62%) or satisfactory (35%), but panel participants shifted to a more cautious stance on future conditions, with only 20 percent expecting future conditions to be better and two-thirds expecting future conditions to be the same (64%).

Executives are also more cautious about future growth. A greater share of executives expects the pace of hiring new employees, revenue growth and customer activity to decrease over the next three to six months than to increase.

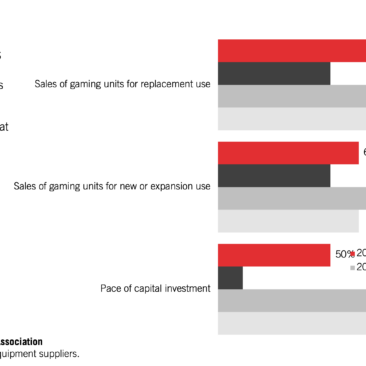

Even as executives are more cautious about future business conditions, plans for investment remain positive, reflecting long-term optimism for industry growth. More executives expect capital investment (21% net positive) and gaming units in operation at existing properties (14% net positive) will increase over the three to six months than decrease. Gaming equipment suppliers are particularly positive, with almost all expecting sales of gaming units for replacement use (88% net positive) and new or expansion use (63%) to increase, both reflecting higher levels of optimism than were reported in the third quarter of 2022.

While six months ago respondents had a net “tight” outlook on company access to credit, that has eased some, with the share reporting access to credit is tight (20%) equally balanced by the share that views it as easy (20%).

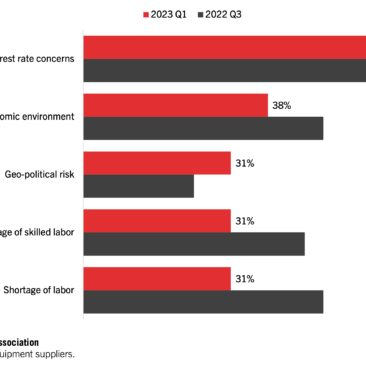

Top concerns among operators have shifted increasingly toward inflationary or interest rate concerns (69%), with slightly fewer reporting concerns about shortages of labor (31%).

Detailed Findings

Background & Methodology

The Gaming Industry Outlook Index is prepared on behalf of the American Gaming Association by Oxford Economics and presented in partnership with Fitch Ratings. It provides a timely measure of recent growth and future expectations. This release represents the fourth release of the index.

Current Conditions Index:

- The Current Conditions Index measures activity in the U.S. casino gaming industry during the most recent quarter. It is based on three components: gaming revenue, employment, and wages and salaries. Each component is adjusted to control for seasonal patterns and monetary measures are adjusted for inflation. Data is estimated through the most recent quarter for each index component based on available monthly data as of the point of index calculation. The index is re-estimated as additional information becomes available for past quarters.

- The Current Conditions Index reflects the composite growth of the three components on an annualized basis. Index values above 100 indicate activity expanded during the quarter, while index values below 100 indicate a contraction. Index values are scaled to be consistent with annualized growth. For example, an index value of 103 is consistent with a 3 percent annualized pace of growth. The index controls for typical seasonal patterns, and index values may be directly compared to the pace of change in previous periods.

- When shown graphically, the Current Conditions Index compresses the most extreme values (index values below 80 or above 120). Individual observations are shown as well as a smoothed series, similar to a moving average, to help convey shifts in industry conditions.

Future Conditions Index:

- The Future Conditions Index measures the expected direction of conditions in the U.S. casino gaming industry over the coming six months. It is based on the following three components: economic conditions (measured as Oxford Economics’ forecast for growth in personal disposable income, household net worth, and consumer spending on services), consumer intentions to visit a casino in the future, and the aggregate sentiment expressed in the Gaming Executive Panel. The Future Conditions Index is scaled so that index values correspond to the expected growth rate in industry conditions as measured by the Current Conditions Index. For example, an index value of 103 is consistent with a 3 percent annualized pace of expected growth.

- The economic conditions measure is based on Oxford Economics’ forecast of growth in real disposable income, household net worth, and consumer spending on services. The components of the index were selected based on the contribution each indicator makes to predict future movements in the Current Conditions Index. Casino executive sentiment is measured through the aggregate measure of positive responses minus negative responses across a set of survey questions.

-

- For example, one of the survey questions included in this aggregate is the pace of hiring new employees. The net positive response for that question is calculated as the share of responses that expect an increase in the pace of hiring new employees over the next three to six months, minus the share that expect a decrease in hiring. This net positive response is averaged with responses to a selected set of other survey questions (e.g., the pace of revenue growth, the pace of growth in wages and benefits, expectations of future business conditions) to calculate the average net positive response as a measure of casino executive sentiment.

- The Future Conditions Index is based in part on Oxford Economics’ outlook for the economy:

- The U.S. economy outperformed expectations in recent quarters but is forecast to experience a mild recession in the second half of 2023. Consumers will come under pressure as nominal income growth softens, savings buffers decline, and inflation remains high. Tightening credit conditions and the economic slowdown will reduce business investment spending. The recession is expected to be mild as there are no glaring imbalances in the economy’s balance sheet.

- Each of the economic drivers in the Future Conditions Index (disposable income growth, household net worth, and consumer spending) are expected to decline in real terms during the second half of 2023 before improving in the first half of 2024.

Gaming Executive Panel

- The Gaming Executive Panel consists of senior-level AGA member executives selected to represent the breadth of the casino gaming sector. Respondents were segmented across three primary categories: casino operators and owners, gaming equipment suppliers, and iGaming and/or sportsbook operators.

- The Q1 2023 survey was conducted between March 29 and April 10, 2023. A total of 26 executives responded, including executives at the major international and domestic gaming companies, tribal gaming operators, single-unit casino operators, major gaming equipment suppliers, and major iGaming and/or sports betting operators.

SOURCE: American Gaming Association.