American Gaming Association – 2023 Second Quarter Commercial Gaming Revenue Tracker

Quarterly Gaming Revenue Again Surpasses $16 Billion

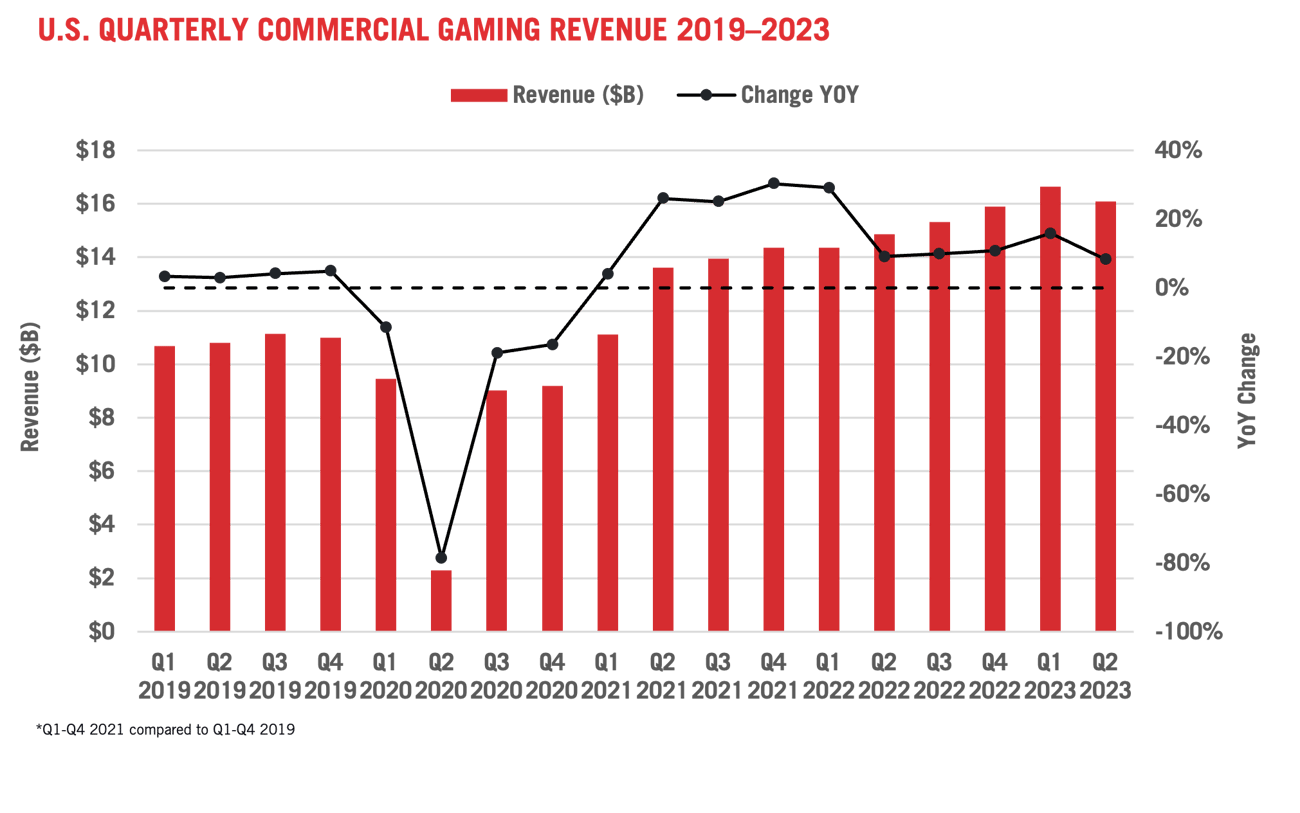

WASHINGTON, DC (August 16, 2023) — Following an exceptional Q1 which saw more than 16 percent annual growth in gaming revenues, U.S. commercial gaming revenue growth slowed significantly in the second quarter. Despite the decelerating rate of growth, nationwide gaming revenue nevertheless expanded by 8.3 percent year over year in Q2, surpassing $16 billion for a consecutive second quarter.

WASHINGTON, DC (August 16, 2023) — Following an exceptional Q1 which saw more than 16 percent annual growth in gaming revenues, U.S. commercial gaming revenue growth slowed significantly in the second quarter. Despite the decelerating rate of growth, nationwide gaming revenue nevertheless expanded by 8.3 percent year over year in Q2, surpassing $16 billion for a consecutive second quarter.

Data compiled by the American Gaming Association shows that revenue from commercial gaming, encompassing traditional casino games, sports betting and iGaming, reached $16.10 billion, marking the industry’s second highest-grossing quarter ever and the tenth consecutive quarter of annual growth.

After the highest grossing first half of a year in its history, the commercial gaming sector is in a strong position for another record-setting year, despite increasingly difficult annual comparisons in the second half. Through June, gaming revenue was pacing 12.0 percent ahead of the same period in 2022, totaling $32.74 billion.

Land-Based Revenue Stabilizes, Overall Growth Driven by Online

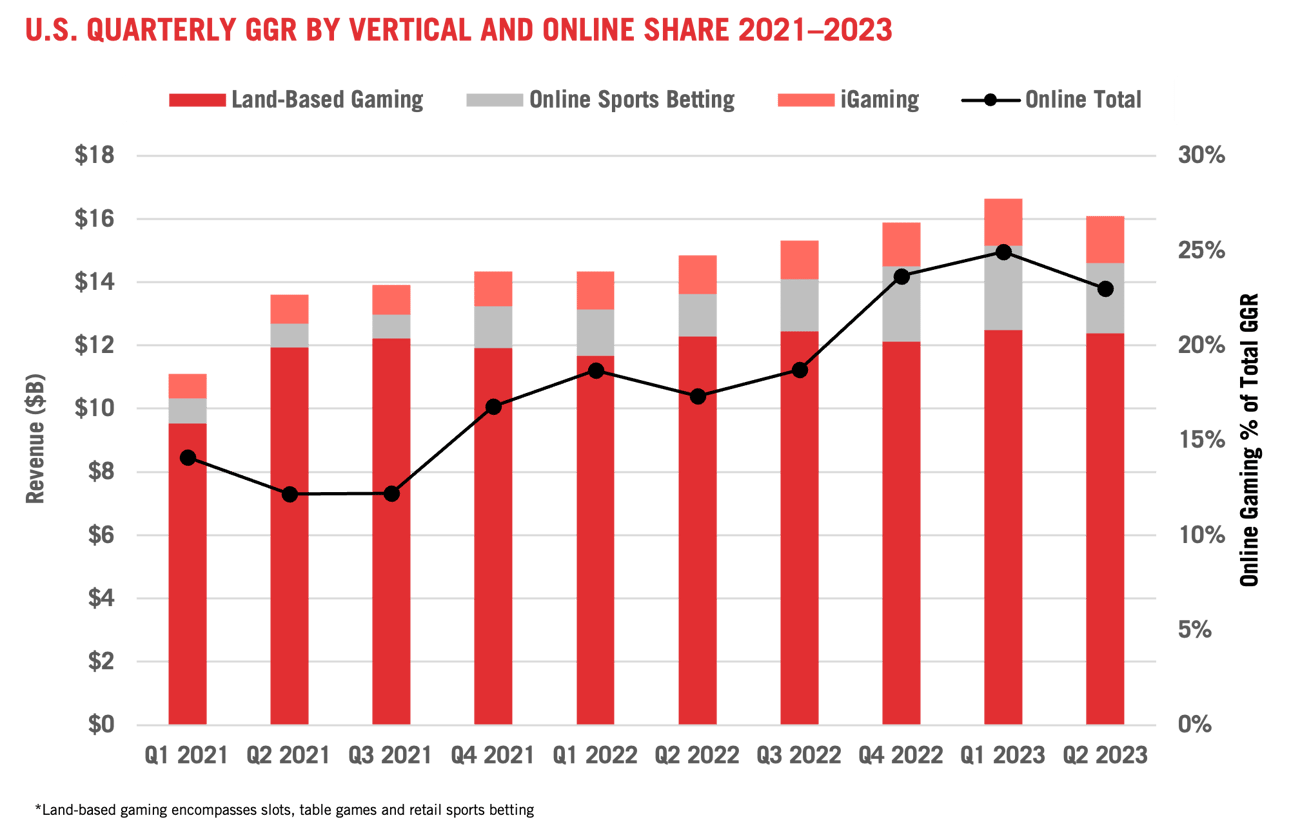

In Q2, the growth in total gaming revenue was again fueled by the online gaming verticals – particularly online sports betting – while land-based gaming was relatively flat.

Quarterly revenue generated by land-based gaming – casino slots, table games and retail sports betting – reached $12.38 billion, essentially flat from Q1 (-0.3%). Annual growth slowed to 0.9 percent, down from a pace of 7.0 percent in Q1 and 1.6 percent in Q4 2022. Conversely, online gaming revenue surged 44.2 percent year-over-year as online sports betting and iGaming revenue reached $3.71 billion. Online revenue expansion was mainly driven by the introduction of online sports betting in Kansas, Maryland, Massachusetts and Ohio within the past year.

Although a lighter sports betting calendar led to a sequential decline in the online share of overall gaming revenue from Q1, online sports betting and iGaming still accounted for 23.0 percent of quarterly commercial gaming revenue.

Growth in Tax Revenue Outpace Gaming Win

The expansion of gaming revenue has led to a windfall in taxes for state and local governments in commercial gaming states. In Q2, commercial gaming operations paid an estimated $3.62 billion in direct gaming taxes to state and local governments. Estimated Q2 gaming tax revenue growth of 9.6 percent outpaced the 8.3 percent growth in gaming revenue. This is reflective of quarterly growth that was dominated by sports betting and iGaming – verticals that are on average subjected to higher tax rates.

At the halfway point, the gaming industry is on track to generate more gaming tax revenue for state and local governments in 2023 than in any previous year. The approximately $7.28 billion in gaming taxes paid during the first six months is 13.0 percent ahead of the same period in 2022.

Note that these tax figures only cover specific state and local taxes directly linked to gaming revenue. They do not encompass the billions of dollars paid by the industry in the form of income taxes, sales taxes or various corporate taxes, nor does it incorporate the payroll taxes paid by gaming operators and suppliers. Federal excise tax payments made by sports betting operators are also excluded from the total.

Most States Accelerate Year-Over-Year, 31 On Pace to Surpass 2022

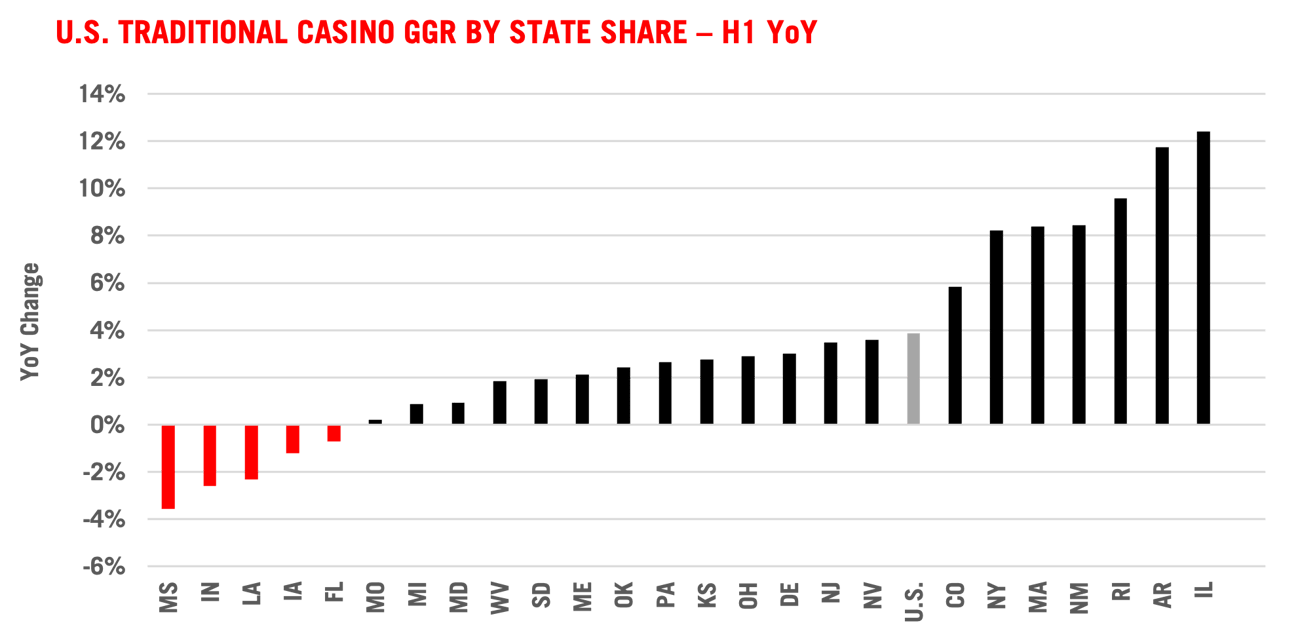

At the state level, 23 of 34 commercial gaming jurisdictions that were operational one year ago increased Q2 revenue from 2022. Among gainers, two states – Massachusetts and Virginia – marked all-time records for a single quarter due to the recent inception of sports betting and land-based casino respectively.

Through June, 31 of 34 commercial gaming jurisdictions are on pace to exceed 2022 revenue totals, with only three states trailing last-year’s H1 performance: Florida, Indiana and Mississippi.

Traditional Gaming Revenue Nearly Ties Quarterly Record

Boosted by the opening of new commercial casinos in Illinois, Nebraska and Virginia, traditional casino gaming generated quarterly revenue of $12.27 billion from slot machines and table games in Q2. Second quarter revenue from traditional land-based gaming grew 0.9 percent year-over-year while falling just short of the single-quarter record set in Q1 (-0.3%).

Casino slot machine revenue increased 2.2 percent year-over-year, reaching a new quarterly high of $8.89 billion. Table game revenue settled at $2.46 billion, a 2.1 percent drop from last year largely due to significant declines in table game revenue in Indiana, Mississippi and Ohio.

The separate slot and table game figures do not include data from Louisiana and Michigan, though their aggregates are captured in the combined figure.

At the state level, of the 25 states that offered traditional casino gaming a year ago, 12 states increased combined revenue from slot and table games during the second quarter. Through the first half of 2023, traditional casino revenue showed year-over-year growth in 20 out of 25 states, while five states saw declines.

Strong Hold Rates Drive Continued Sports Betting Gains

While the start of summer and a slower sports calendar brought with it a sequential slowdown in sports betting activity compared to Q1, second quarter sports wagering revenue still jumped 58.5 percent year-over-year to $2.33 billion, a new Q2 record.

Of the quarterly total, $347.1 million was generated in states that weren’t operational one year ago: Kansas, Massachusetts and Ohio. Excluding new markets, quarterly sports betting revenue was up 34.9 percent year-over-year. After the introduction of online sports betting in Massachusetts during March, the Commonwealth swiftly establishing itself as a significant sports betting market, generating revenue of $155.3 million from a handle of $1.37 billion during its first full quarter of operation.

After six months of 2023, commercial sports betting remains on track for another record-setting year with the year-to-date total reaching $5.18 billion, up 66.5 percent from the same period last year. Same market revenue grew 40.1 percent compared to the first half of 2022.

Nationwide, Americans bet $23.91 billion on sports in the second quarter, accelerating by 21.7 percent compared to the same period in 2022. Handle growth was relatively moderate compared to the 58.5 percent jump in revenue, reflecting rising hold rates across several jurisdictions in recent quarters. Through the first half of 2023, every sports betting jurisdiction that was live in H1 2022 saw revenue accelerate at a faster pace than handle. This includes 11 more mature markets that experienced simultaneous growth in handle and contraction in revenue.

iGaming Growth Story Continues

The iGaming vertical continued its robust growth with $1.48 billion in Q2 revenue, up 22.6 percent compared to Q2 2022 and tying Q1 for a single-quarter record. At the state level, iGaming set new quarterly revenue records in Connecticut, New Jersey, Pennsylvania and West Virginia.

After two very strong quarters, iGaming is on track for another record year with year-to-date revenue of $2.97 billion, 22.6 percent ahead of the same period last year. Six iGaming markets were live during the first half of 2023 (excluding Nevada online poker), unchanged from a year ago.

SOURCE: American Gaming Association.

Tags: AGA, Commercial Gaming Revenue Tracker, 2Q 2023