Takeover of ZEturf by La Française des Jeux

Autorité makes the transaction conditional on commitments

FRANCE (September 18, 2023) — On 6 June 2023, La Française des Jeux notified the Autorité de la concurrence of its plan to acquire sole control of the ZEturf Group.

After examining the transaction, the Autorité cleared the acquisition subject to conditions. FDJ has entered into behavioural remedies to address the identified risks of harm to competition.

Parties to the transaction

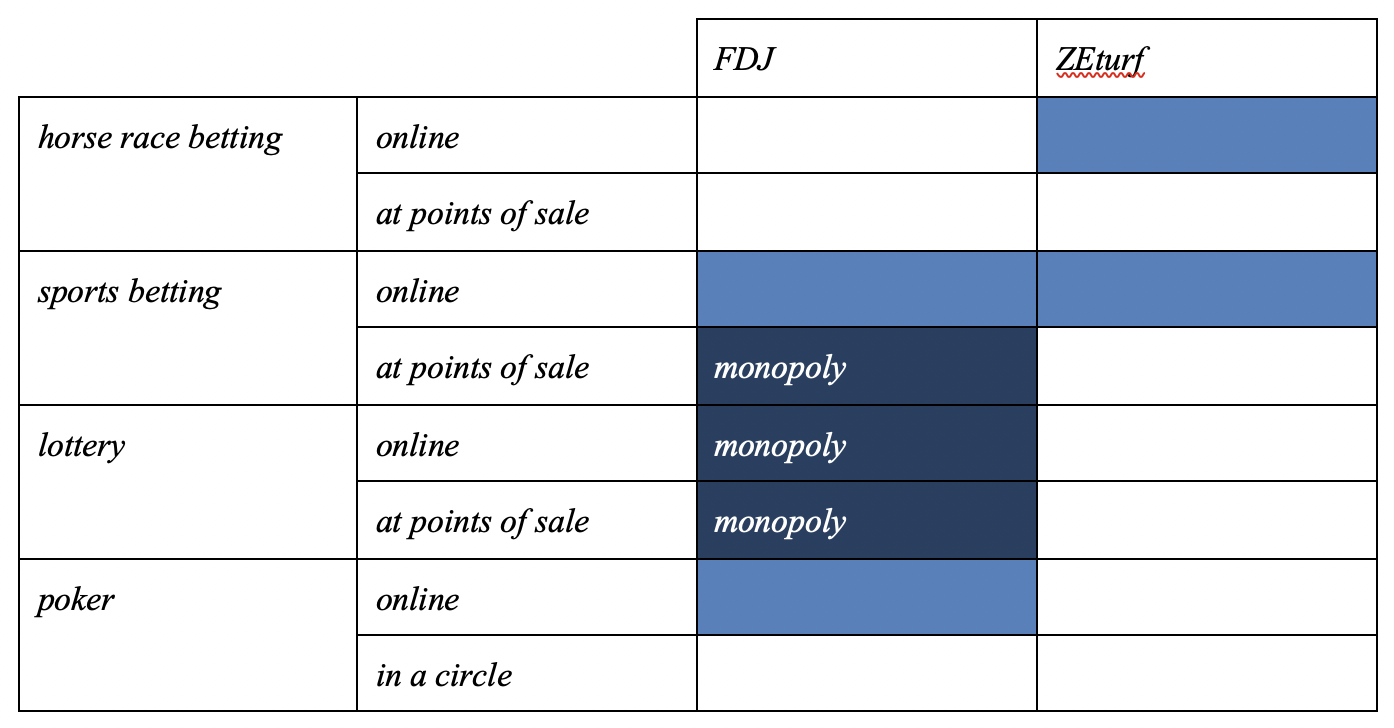

La Française des Jeux and its different subsidiaries form the FDJ Group (hereinafter FDJ). FDJ is active primarily in the games of chance and gambling sector. In France, the Group has exclusive rights to organise and manage lottery games at points of sale and online, and to offer sports betting games at points of sale. It is licensed for its online sports betting and online poker activities.

Together with its various subsidiaries, RBP Luxembourg forms the ZEturf Group (hereinafter ZEturf). Through its subsidiary ZEturf France Limited, ZEturf is licensed in France to offer online horse race betting under the ZEturf brand, and online sports betting under the ZEbet brand. Other subsidiaries include Zetote System, which manages common horse race betting pools collected by ZEturf and other online horse race betting operators.

Activities of the parties prior to the transaction:

The Autorité has identified competition problems that may arise from FDJ’s monopoly on lottery games (online and at points of sale) and sports betting at points of sale.

First, the Autorité examined whether the transaction would have horizontal effects on the online sports betting market, where FDJ and ZEturf are both present. In view of the parties’ low combined market shares, the Autorité ruled out any risk of harm to competition through horizontal effects.

Second, the Autorité examined whether the transaction had conglomerate effects. At the end of its analysis, it identified competitive problems resulting from the concentration within the same entity of FDJ’s monopoly activities linked to the distribution of games and bets and ZEturf activities in the online horse race and sports betting markets.

The Autorité considers that, as a result of its monopoly on the distribution of lottery games (online and at points of sale) and sports betting at points of sale, the new entity could have been tempted to use its exclusive right as a lever to restrict competition in the markets open to competition for online horse race and sports betting.

As a result, the new entity would have been able to link its monopoly game offers to those of the target by promoting online horse race and sports betting to monopoly game players, putting in place commercial offers encouraging monopoly game players to play online horse race and sports betting, creating confusion between the customer paths of monopoly game players and online horse race and sports betting players, or using a single customer account for all the games offered.

In addition, as regards horse race betting in particular, the new entity could terminate or make it more difficult for competitors to access the common [1] betting pools managed by the new entity or to remove horse race bets collected by the new entity from these pools.

The analysis conducted by the Autorité demonstrated that the new entity had the ability and incentive to consider implementing such strategies and that they would have been effective to the detriment of ZEturf’s competitors. The Autorité therefore concluded that the risk of harm to competition through conglomerate effects could not be excluded.

The proposed commitments

FDJ has entered into behavioural remedies to address the risks of harm to competition identified by the Autorité.

Separation of monopoly and competitive gaming activities

FDJ has committed to not using its monopoly gaming activities (online and point-of-sale lottery games and point-of-sale sports betting) to develop competitive games (online horse race and sports betting).

Accordingly, FDJ has committed to clearly separating its monopoly gaming activities from its competitive gaming activities, in particular:

- by setting up separate websites or applications for each type of activity, with no common home page and no gateway between them;

- by creating or maintaining a player account for each activity, with no possibility of a gateway between accounts;

- by refraining from recreating a customer database to promote its competitive gaming activities, which would include data relating to players of monopoly games.

FDJ has also committed to not promoting any of its competitive games in its network’s points of sale or to online lottery players, and to operating separate social network accounts for each type of activity.

In addition to these measures, its sales teams will receive training on how to respect these commitments. Furthermore, FDJ has committed to organising its competitive gaming activities within one or more dedicated subsidiaries.

Access to common pools by competitors

FDJ has also committed to giving any operator authorised in France to offer online horse race betting access, under objective and non-discriminatory conditions, to the common pool of online horse race betting stakes that it manages, and to continuing to implement current pooling agreements, under the conditions in force on the date of the merger. FDJ has also committed not to cease pooling its online horse race bets within the common pool open to third-party operators.

In light of the commitments made by FDJ, the Autorité cleared the transaction following the phase 1 examination.

The conglomerate effects

Conglomerate effects are likely to occur when the new entity expands or strengthens its presence in markets that are different from those in which it is active, but whose connectedness may allow it to increase its market power.

1 In France, horse race betting is only authorised as mutual betting, in which all the sums played by the bettors are merged into a single pool to be shared between the winners. For this type of bet, the larger the pool to be shared, the greater the amounts that can potentially be redistributed to winners in the form of winnings.

Full text of the decision (in French).

SOURCE: The Autorité de la concurrence.